Thu Sep 08 00:00:00 UTC 2022

Should you book short term profits on your SIPs

Global equity markets were highly volatile in the first half of the year due to high inflation and the War in Ukraine. Unlike the past, Indian retail investors showed a lot of maturity in volatile markets and most investors continued their Systematic Investment Plans (SIPs). As per AMFI monthly SIP data, monthly SIP inflows dipped by only 3% month on month basis, between March and April 2022 (source: AMFI); it again grew from May onwards. After bottoming out towards the end of June, equities are trending upwards again. From its low of 15,293 on 17th June, Nifty 50 has risen by 16% (as on 30th August 2022). Many investors who were wise enough to continue with their SIPs are now sitting on some short-term profits. What should you do now?

Should you book profits now?

If you continued Rs 10,000 monthly SIP in Nifty 50 TRI from March, you would be sitting on a profit of nearly Rs 4,000 as of end of August you may be tempted to book profits now. Loss aversion is common behavioral bias among investors. Investors with loss aversion bias often use anchoring bias to support their loss aversion bias. Anchoring bias is based on some belief or feeling, and looking for information that supports the belief.

For example, if you have made a short term profit, you may feel the urge of protecting your profits by booking them. Now you may start looking for news e.g. possible recession in the US etc that will support your belief that the market will correct in the near future. You should understand that this short-termism is harmful to long-term wealth creation.

When should you redeem your investments?

Mutual fund investments should be based on financial goals. SIPs are usually meant for your long term financial goals e.g. children’s higher education, children’s marriage, retirement planning, wealth creation etc. Usually these goals have 7 to 10 years or longer investment tenures. You should redeem your investments only when you have reached your financial goals. The only other reason to redeem your mutual fund investments can be underperformance of your mutual fund scheme versus its benchmark index over sufficiently long investment horizon (e.g. 3 years). In such case, you should replace the scheme with a better performing scheme. Other than these two reasons, you should remain disciplined in your SIPs, irrespective of short term market movements.

What if market falls in the near future?

Even though financial advisors always suggest long term investment horizon for SIPs, it is natural for investors to worry about losing their hard earned savings in a big market crash. For example, there is a lot of talk in the electronic and digital media about a possible recession in the US. The US Fed Governor, Jerome Powell alluded to the possibility of recession in the US at the end of this interest rate cycle. Will an impending recession in the US trigger a big correction in Indian equity market? It is impossible to predict short term market movements; even experts fail to do so. We can only rely on actual data. Indian equities have not corrected significantly even after the Fed Governor’s comments. Furthermore, even if there is some impact of US equity market correction on Indian equities, historical data shows that equity as an asset class has the potential to create wealth over long investment horizons across market cycles.

SIPs have created wealth across market cycles

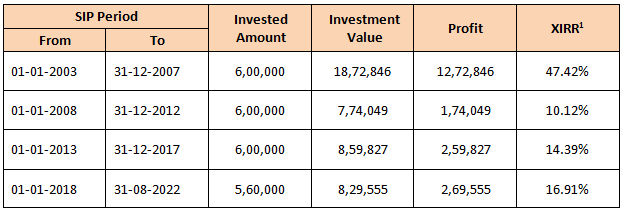

We have divided the last 20 years or so, into 4 different 5 year investment tenures, starting from 1st January 2003 to 31st August 2022. The table below shows the returns of Rs 10,000 monthly SIP in Nifty 50 TRI for each of these tenures. Each of these investment periods, except the first one, had at least one major bear market (more than 20% correction). Yet you can see that SIP in Nifty 50 TRI was able to generate inflation beating returns and create wealth for investors over sufficiently long investment horizons across different market conditions.

SIPs, in fact, take advantage of market volatility through Rupee Cost Averaging. You can see that Nifty SIP was able to generate double digit return even in the period which included the worst financial crisis of our times e.g. Global Financial Crisis of 2008.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st January 2003 to 31st August 2022. Disclaimer: Past performance may or may not be sustained in the future.

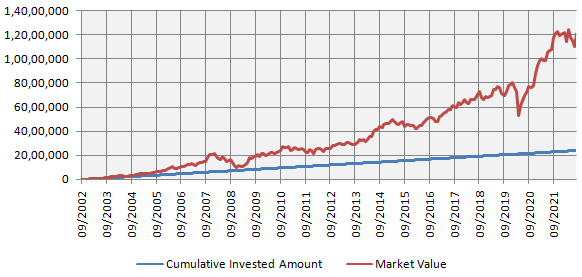

Power of compounding – wealth creation

Compounding is profit on profits re-invested. The power of compounding can create substantial wealth over long investment tenures. The chart below shows wealth created by Rs 10,000 monthly SIP in Nifty 50 TRI over the last 20 years ending 31st August 2022. With a cumulative investment of Rs 24 lakhs, you could have accumulated a corpus of Rs 1.23 Crores over the last 20 years. The SIP return (XIRR1) over this period was 14.43%. If you remain disciplined and patient you can create substantial wealth in equities.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st September 2022 to 31stAugust 2022. Disclaimer: Past performance may or may not be sustained in the future.

Conclusion

In this blog post, we have discussed why you should resist the urge to book short term profits in your SIP. To quote the legendary investor, Warren Buffett, “We don’t have to be smarter than the rest. We have to be more disciplined than the rest”. A disciplined investor is in control of his / her emotions. If you want to create wealth you need to remain invested for the long term.

Footnote:

1. XIRR (Extended Internal Rate of Return) is a method of calculating returns on investments where there are multiple transactions taking place in different times. We have used XIRR formula in Microsoft Excel to calculate SIP returns. XIRR is a variant of Internal Rate of Return (IRR), which is used to calculate returns of multiple cash-flows. IRR requires cash-flows to be at equal intervals. In mutual fund SIPs, the cash-flows may not be at equal intervals because some months may have 30 days, while others may have 31 days. Also if the SIP date falls on a non-business day (e.g. Sunday) in a particular month, the transaction will take place on the next business day. The advantage of using the XIRR formula in MS Excel is that unlike IRR, it does not require cash-flows at equal intervals. It can calculate returns on cash-flows at any interval.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.