Tue Mar 28 00:00:00 UTC 2023

How SWP and STP Taxation works

Systematic Withdrawal Plan (SWP) and Systematic Transfer Plan (STP) are mutual fund facilities which offer solutions to different investment needs. SWP provides fixed cash-flows to investors. STP enables investors to transfer fixed amounts at regular intervals (e.g. weekly, monthly, etc.) from one scheme (usually low volatility scheme) to another scheme (high volatility). In this article, we will discuss the taxation of SWP and STP.

SWP and STP transactions involve redemptions for tax purposes

It is important for investors to understand that both SWP and STP transactions are considered to be redemptions for tax purposes. Each SWP instalment is a straightforward redemption; the asset management company (AMC) will redeem certain number of units based on prevailing net asset value (NAV) to generate the SWP cash-flows for you. STP is essentially a series of switches from one scheme to another scheme. For tax purposes, a switch is considered to be a redemption and re-investment. You should know that any redemption may lead to capital gains tax incidence depending on whether you have made a profit or loss on the redemption of units.

What is a capital gain?

Capital gain is the appreciation in the value (redemption value – purchase value) of the units of a mutual fund that are redeemed. Investors should know that capital gains are taxed only at the time of redemption or sale. In other words, capital gains tax is levied only on realized gains. If your mutual fund units have appreciated in value and you are still holding them, then there is no taxation on the unrealized gains.

How is capital gains calculated?

Capital gains can be either without indexation or with indexation depending on the type of scheme and holding period.

- Capital gains without indexation = (Redemption NAV – Purchase NAV) * Number of units redeemed

- Capital gains with indexation = {Redemption NAV – Purchase NAV * (CII year of redemption / CII year of purchase)} * Number of units redeemed

We will discuss capital gains with indexation in more details later in this article.

What is capital gains tax?

If redemption of units for SWP or STP results in capital gains then it will lead to a capital gains tax incidence. In other words, you may have to pay tax on your capital gains. The capital gains tax rate will depend on the holding period of the units i.e. how long you had held the units before you redeemed, amount of capital gains and type of scheme. For tax purposes there are two types of schemes – equity and non-equity. Capital gains taxation is different for equity and non-equity funds. Before we delve into the details of capital gains taxation let us understand what equity and non-equity funds are.

Equity and non-equity funds

- Equity Funds: From a tax perspective, a scheme in which at least 65% of the portfolio is allocated to domestic (Indian) equities is an equity fund. Please note that derivatives whose underlying assets are stocks (or stock indices) are also considered to be equity. Apart from funds which are categorized as equity funds as per SEBI’s classification, certain types of hybrid funds where average gross equity allocation is more than 65%, like aggressive hybrid funds, arbitrage funds, equity savings funds, balanced advantage funds are also treated as equity funds from a tax perspective. ETFs and index funds are also taxed as equity funds. If you are unsure about the tax treatment of a mutual fund scheme in your portfolio, you should consult your financial advisor.

- Non-Equity Funds: Non-Equity funds from a tax standpoint are mutual fund schemes which have less than 65% allocation to equity in their portfolio. Non-equity funds include schemes which are classified as debt funds as per SEBI’s definitions and certain types of hybrid funds where equity allocation is less than 65%, like conservative hybrid funds. Investors should note that mutual fund schemes which invest primarily in international equities are taxed as non-equity funds, even though the underlying asset class is equity. Investors should also note that Fund of Funds, whether the underlying funds are equity funds or not, are treated as non-equity funds. Gold ETFs, Gold fund of funds are also treated as non-equity funds. Again, if you are unsure about the tax treatment of a mutual fund scheme in your portfolio, you should consult your financial advisor.

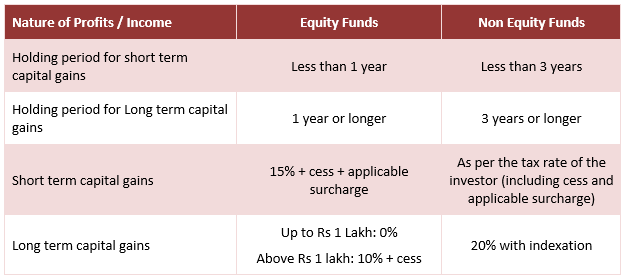

Capital gains taxation

- For equity funds: If you sell units of equity funds before completion of 1 year from date of investment, then it is treated as short term capital gains from a tax standpoint. Short term capital gains in equity funds are taxed at the rate of 15% plus cess and surcharge. If you sell units of equity funds after completion of 1 year from date of investment, then it is treated as long term capital gain. Long term capital gains of up to Rs 1 lacs tax exempt. Long Term Capital gains in excess of Rs 1 Lakh are taxed at 10% plus cess.

- For non-equity funds: If you sell units of non-equity funds before completion of 3 years from date of investment, then it is treated as short term capital gains from a tax standpoint. Short term capital gains in non equity funds will beadded to your income in your Income Tax Returns (ITR) and taxed as per the tax rate of your income tax slab. If you sell units of non equity funds after completion of 3 years from date of investment, then it is treated as long term capital gains from a tax standpoint. Long term capital gains of non-equity funds are taxed at 20% with indexation. To calculate capital gains with indexation, you should index your purchase cost by multiplying the purchase cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchase cost from sales value.

Summary of capital gains taxation

How will your SWP be taxed?

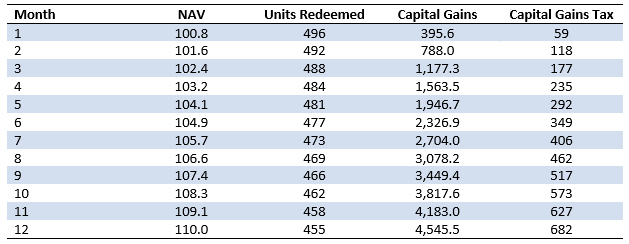

Let us understand this with the help of an example. Let us assume you invested Rs 50 lakhs in an equity fund at the beginning of a financial year (i.e. 1st April). The purchase NAV of your scheme is Rs 100. You are withdrawing Rs 50,000 every month through SWP. The annualized return of your scheme is 10%. For the sake of simplicity, we will ignore exit load and tax surcharge. The table below shows your SWP cash-flows and taxation for the first 12 months (short term capital gains tax).

Source: Advisorkhoj Research based on above assumptions

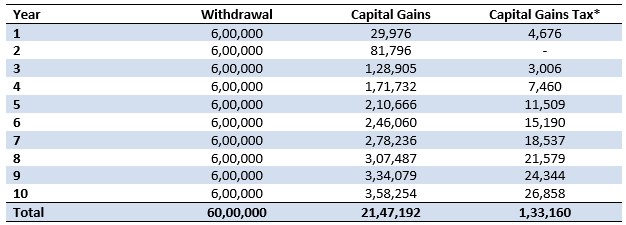

The table below shows the capital gains taxation of your SWP over tenure of 10 years. From year 2, SWP will attract long term capital gains tax

Source: Advisorkhoj Research based on above assumptions.*Includes 4% education cess

How will your STP be taxed?

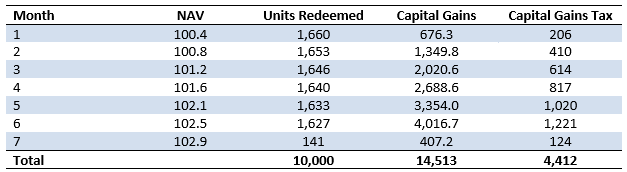

Like SWP, Let us understand STP with the help of an example. Let us assume you invested Rs 10 lakhs in a debt fund at the beginning of a financial year (i.e. 1st April) and are transferring Rs 166,667 every month to an equity fund i.e. your STP tenure will be around 6 months. In the 7th month you will switch all the balance units in your debt fund to the equity fund. The purchase NAV of your scheme is Rs 100 and the annualized return of your scheme is 5%. The purchase NAVs of the target scheme (transferee scheme) i.e. equity fund or the returns of target scheme (transferee scheme) returns are irrelevant for tax calculations. Again for the sake of simplicity, we will ignore exit load and tax surcharge. Let us assume that you are in the highest tax bracket i.e. 30%. The table below shows your STP cash-flows and taxation.

Source: Advisorkhoj Research based on above assumptions.*Includes 4% education cess

In this example, since the STP is taking place from a debt fund, short capital gains taxation of non equity funds will apply. We had discussed earlier that short term capital gains (holding period of less than 36 months) in debt funds are taxed as per the income tax rate of the investor.

Conclusion

In this post, we have discussed how SWP and STP are taxed. When filing your ITR, you should carefully go through all the mutual fund transactions made during the financial year, note all the redemptions,including your SWP and STP transactions to calculate the capital gains correctly. You can get your capital gains statements online from Registrar and Transfer Agents (RTAs). You can also ask your mutual fund distributor to provide you with one. You should disclose your capital gains and dividends in your income tax returns and pay taxes accordingly. If you are in any doubt you should consult with your tax consultant.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.